With a rapidly changing financial system, even a simple question like, ‘what is money?’ can become complex. With new financial apps and rise and fall of various flavors of digital currency, it seems that anything or maybe everything could be money.

Abstractly, one can think of money as a medium that stores value that is readily accepted as payment for products, services, or other items of value. With this definition, almost anything could be considered money, and throughout history and around the world, almost everything has been a form of money. Gold, silver, sheep, goats, grain, shells, and unfortunately, people.

Such a broad approach to thinking about money may lead to confusion. A better approach might be to understand the role of various potential candidates for money in our current financial system and how they are related to each other.

In the US there are only two basic forms of money, as defined by the Federal Reserve. These are physical currency (coins and bills, issued by the US Government) and digitally recorded deposits kept at regulated banks. With a few minor exceptions that’s it. If these are the only things that are money, what is everything else?

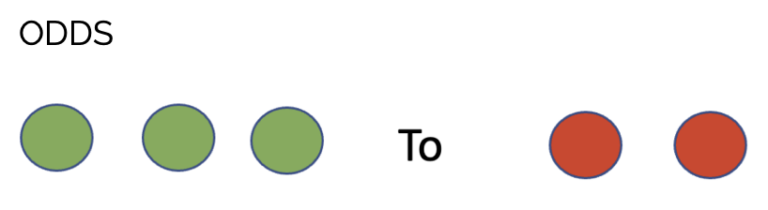

We can break various forms of money-like things into three categories:

Commodities, IOUs (I-Owe-You’s), and Payment Systems. Most things that we might think of as money fall into one or more of these three categories.

Commodities

For much of financial history, money was things, physical things. The best type of things for commercial transactions are things that have an agreed upon value, are easily transportable, and difficult to counterfeit. The classic commodity of this sort is gold, and even until 1971, gold was the basis for the international monetary system and for many years the US had paper certificates that could be converted into gold. Silver is another commodity that has been used to back currencies and as a basis for trade (Growing up I had a silver certificate that I may still have stored in a closet somewhere in my house). However, any commodity (any “thing”) that people are willing to use to denominate transactions is a potential form of money.

While physical commodities may have certain advantages as a means of exchange, they face severe limitations relative to the basic forms of money: currency and bank deposits. Perhaps the most significant disadvantage is the need to store and transfer commodities. For physical commodities such as gold or goats, the difficulty of storage and transfer may be obvious (imagine bringing goats to the mall).

IOUs (“I Owe You”)

Another form of a money-like instrument is an IOU, that is a promise to make a future payment. Before the widespread use of credit cards and in many small towns, people who went to a store often didn’t pay when they left with merchandise, rather the store would keep track of the amount owed. In some cases, the buyer would sign a small note or “chit” stating the amount owed. Merchants might even exchange these IOUs as a form of payment. Banks also issue IOUs in various forms such as cashier’s checks, Certificates of Deposit and Letters of Credit, all of which can be used to facilitate transactions. IOUs can also be from companies and governments. A major advance in the monetary system was establishing deposit insurance, so that specific IOUs (records of deposits) created by banks are backed by the US government, substantially reducing the risk of keeping your money at a bank.

In some cases, non-bank IOUs, promises that can be exchanged for cash on demand or mature within short periods of time can also be a form of money when held by regulated money market funds or on the balance sheet of corporations. (This was the exception to the two types of money described above.) Chips at a casino or Dave and Busters are also IOUs, but most people don’t consider them to be money as they can only be exchanged at one location.

Payment Systems

Many of the other things that we consider to be money are not money, but rather are “payment systems.” If the primary forms of money are currency and bank deposits, how can you use money for a purchase? ATMs, or bank tellers, provide a way to convert money in bank accounts to cash, and the other way around. Currency can be exchanged in real time for a transaction. At some point, however, the amount of cash required can be prohibitive to carry around: Would you like to buy a car with a stack of $20 dollar bills? Would you like to deliver your rent, in cash, to your landlord each month?

As a result, there are several ways to transfer money from your bank account to the seller. Traditionally, checks, which are fundamentally a physical means of transfer of money from one checking account to another, were a widely used form of payment. However, the check itself is not money, rather it is a way of transferring money from one account to another. However, these days the use of checks is declining rapidly and being replaced by electronic means of transfer. For example, many people use some form of bill payment app from their bank. While this may seem to be an electronic transfer system, some electronic bill payments are just checks in disguise. In some cases, when you enter a bill to be paid, the bank still sends a check.

Other forms of payment as ACH and wire transfers are electronic transfers of money, without the need to deliver physical checks from one party to another. The entire transfer takes place electronically without the need to create a physical check as an intermediary.

There has also been substantial growth in other forms of payment including Debit Cards, Credit Cards, Digital Wallets, and other digital payment systems such as Venmo and Paypal. Each of these provides another way of accessing the money you hold in your bank account. Debit cards and Venmo take money directly from your bank account. Credit cards create a temporary IOU that you can pay off monthly, or if you don’t make the full payment convert into revolving debt, generally with very high interest charges. Digital wallets are another way of using a credit cards, with the credit card data being delivered by your phone rather than from a plastic card or a chip imbedded in the card. Despite the fancy exterior, most of these innovations still utilize checking accounts for the underlying storage of money.

What about Crypto?

If Cryptocurrencies aren’t money; what are they. While various forms of cryptocurrency have money-like features, they are best thought of as digital commodities. While they are not physical, they still represent an item in limited supply that people can agree to use as a basis for transactions. While storage and transfer are always issues for physical commodities, for digital commodities, crypto assets were supposedly designed to eliminate these problems. However due to the complexity of operating directly in crypto currencies many people rely on intermediaries to transact and store their crypto assets. Unfortunately, as we have seen, it is possible these entities may be incompetent or corrupt, leading to losses of assets and confidence.

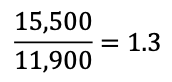

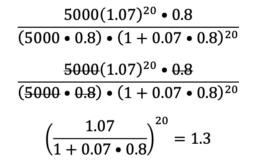

Another characteristic of a good candidate for money is that it has “unit value.” Unit value means that the “price” of something should only change if the cost of the inputs (including profits) change. Thus, anything that changes value on its own, like a commodity, may be a poor choice for money. Since Crypto currency prices vary wildly; they are speculative assets, and not good candidates for money. (Stable coins have been developed to address this issue, but maintaining stability creates other problems.) Although many things have been used as a basis for exchange, governments have been using coinage as a standard of value since ancient times. Throughout history, societies have recognized that using commodities as money can create havoc, and that government issued currencies provide greater value to trade and government management of the economy.

Commodities often become used as currency when governments fail or when they destabilize their own currencies through excessive spending or excessive printing of currency. The current popularity of crypto may be related to the economic disruptions of 2007 and 2008 and a loss of confidence in the banking system.

Crypto assets, therefore, are best thought of as crypto-commodities and should be evaluated and utilized in much the same way as other commodities. They may be a part of a portfolio, but they are not income producing assets and their value may fluctuate widely. They may provide a hedge against certain economic outcomes, but the relationships may be difficult to assess. In addition, extreme care is required in choosing how to store and transact in digital commodities.

Money, money substitutes, and payment systems are likely to continue to evolve rapidly. This creates the risks for individuals, who may face false claims and failed innovations. While skepticism about government may be warranted, especially in underserved communities, the alternatives to government regulated financial entities do not have a good track record, and government regulation is generally a requirement to prevent misuse of customer assets and protection against predatory practices. Best practice, in a period of rapid change, may be to keep most money in traditional bank accounts and be cautious about the use of new payment systems until they are widely-used and a regulatory regime has been established and tested.

Money and FiCycle

Money plays an important role in the FiCycle Math curriculum. First there is an assumed role, which we do not state explicitly. That is, all transactions in our workbook, spreadsheets and projects are denominated in dollars and that transactions, other than a few exceptions, will use money as the means for exchange. We don’t say if payment is made with coins, bills, by check or with an App, but we assume that students know how to purchase something or send money to another person using money.

Second, we focus extensively on distinguishing cash from wealth. Cash, which can refer to currency either as bills or coins, or money held in a checking account, is one aspect of wealth. But wealth also includes other assets and is reduced by debts. Understanding the role of wealth in financial transactions is a central theme of FiCycle.

Third, even while focusing on wealth, access to money is essential for paying bills and lack of money can lead to severe financial consequences, even if a person has other forms of wealth. Budgeting can be viewed as a process for making sure that you have sufficient cash (that is access to money) to make necessary payments.

_________________

M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other liquid deposits, consisting of other checkable deposits (or OCDs, which comprise negotiable order of withdrawal, or NOW, and automatic transfer service, or ATS, accounts at depository institutions, share draft accounts at credit unions, and demand deposits at thrift institutions) and savings deposits (including money market deposit accounts).

The Fed – Developments in Noncash Payments for 2019 and 2020: Findings from the Federal Reserve Payments Study