3 Charts Show Why Research Recommends Combining Math and Finance

Our central belief at FiCycle is that teaching personal finance and mathematics together improves student learning of both. That’s why we created “Financial Life Cycle Mathematics” – a high school algebra course that covers the fundamentals of personal finance.

This belief is based on our research, which provides compelling evidence to justify our approach. Below are three charts that summarize some of our key findings.

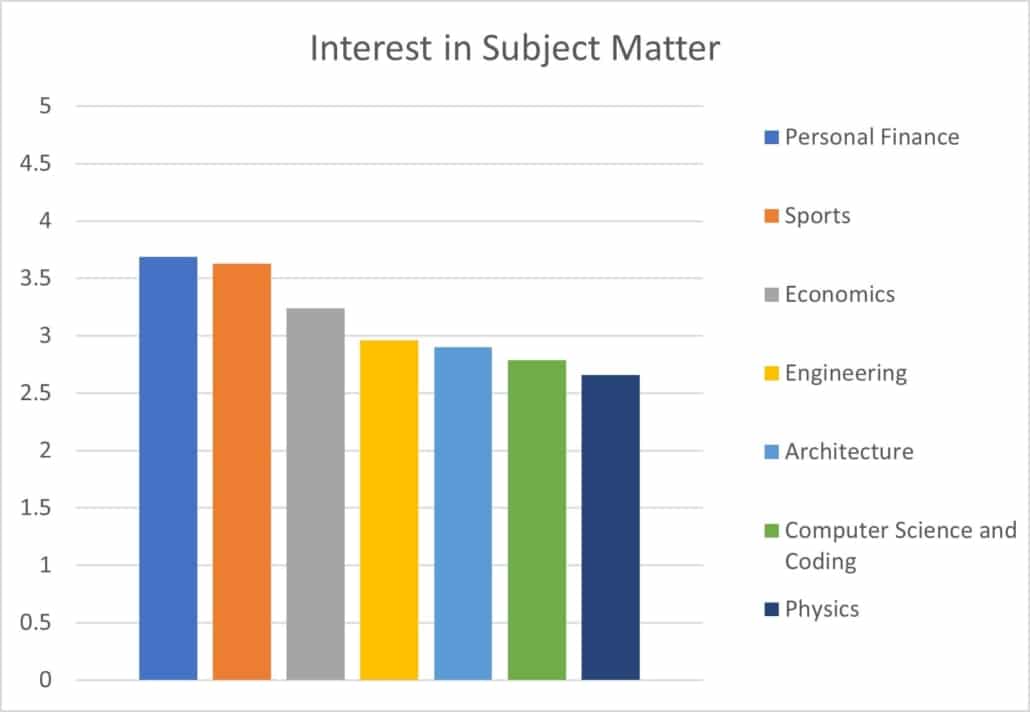

Students find personal finance to be an interesting application of mathematics

- We know students learn math better when they are engaged with the material – when they find it interesting and important.

- When high school students are asked to rate how interesting they find common applications of math, they consistently give personal finance the top rating.

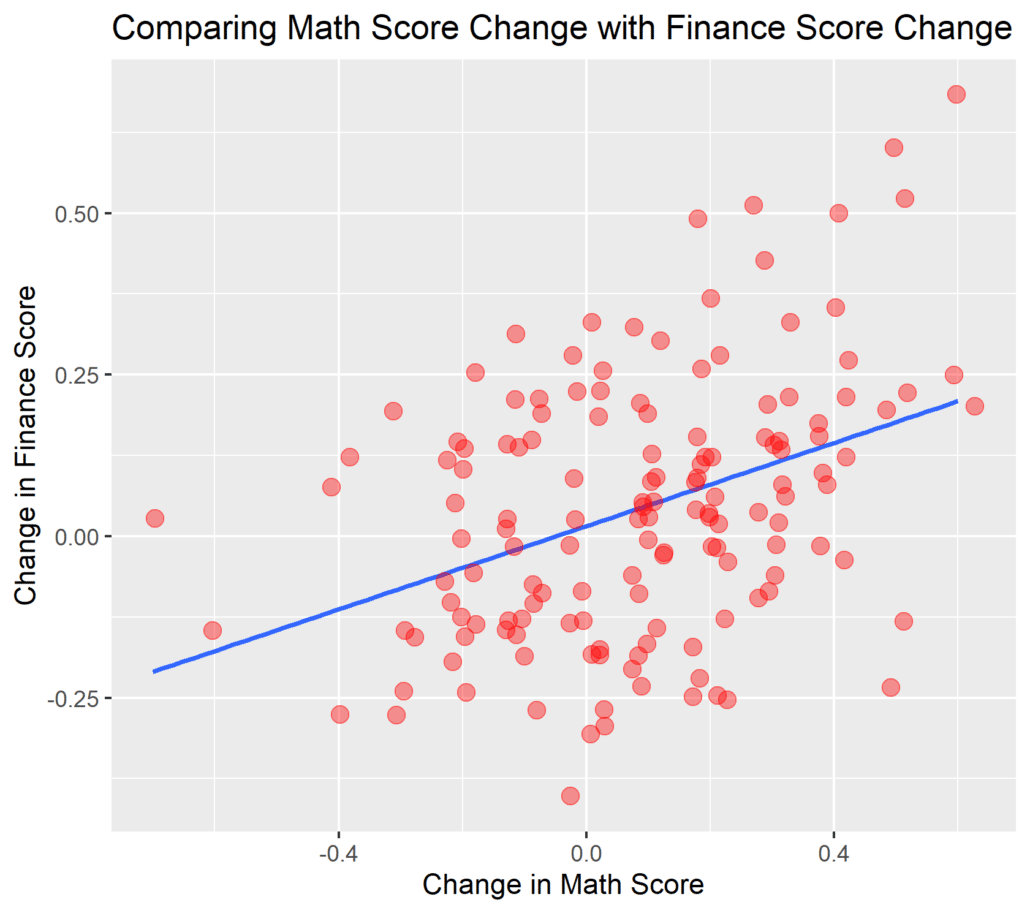

Students’ math and finance learning is interconnected

- When students take our combined math and finance course, we measure their learning gains in both math and financial knowledge.

- Not only do students make significant improvements in both areas: the level of math learning is closely connected to their level of financial learning.

- This tells us that learning math and learning finance are mutually reinforcing.

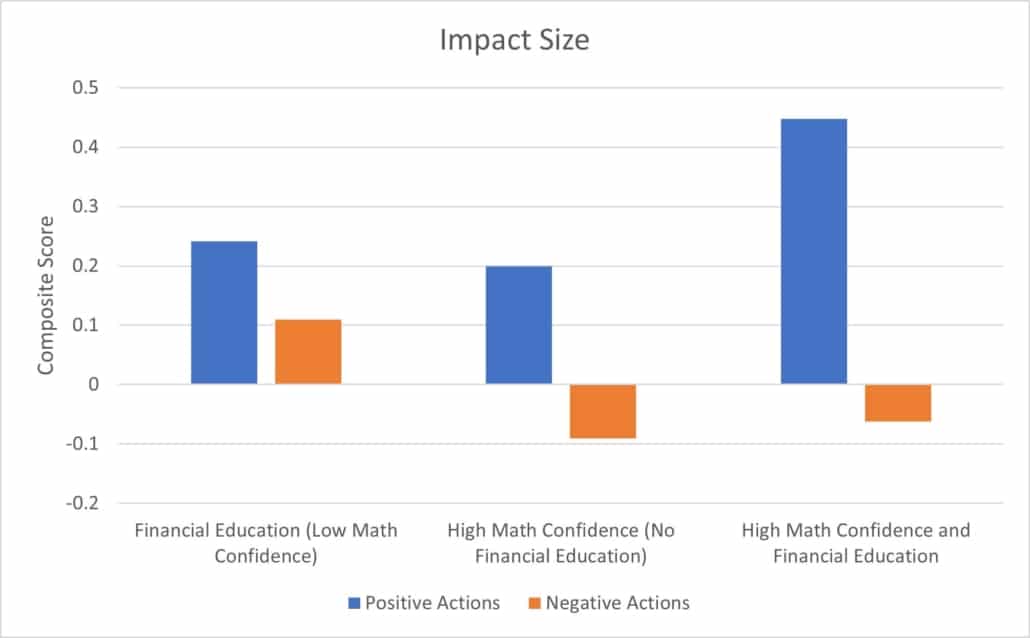

Math knowledge is required to avoid the pitfalls of high financial engagement

- Many traditional financial education programs that don’t include mathematics come with significant risks.

- Enrollees go on to engage with more financial products of all types – this includes negative products like payday loans as well as positive products like savings accounts.

- Combining financial education with high mathematics confidence leads to increased positive behavior but reduced negative behavior, which is what is required for financial wellness.

To find out more about the research and data behind these charts check out the ‘FiCycle Research Overview’ and the other papers on our research page.